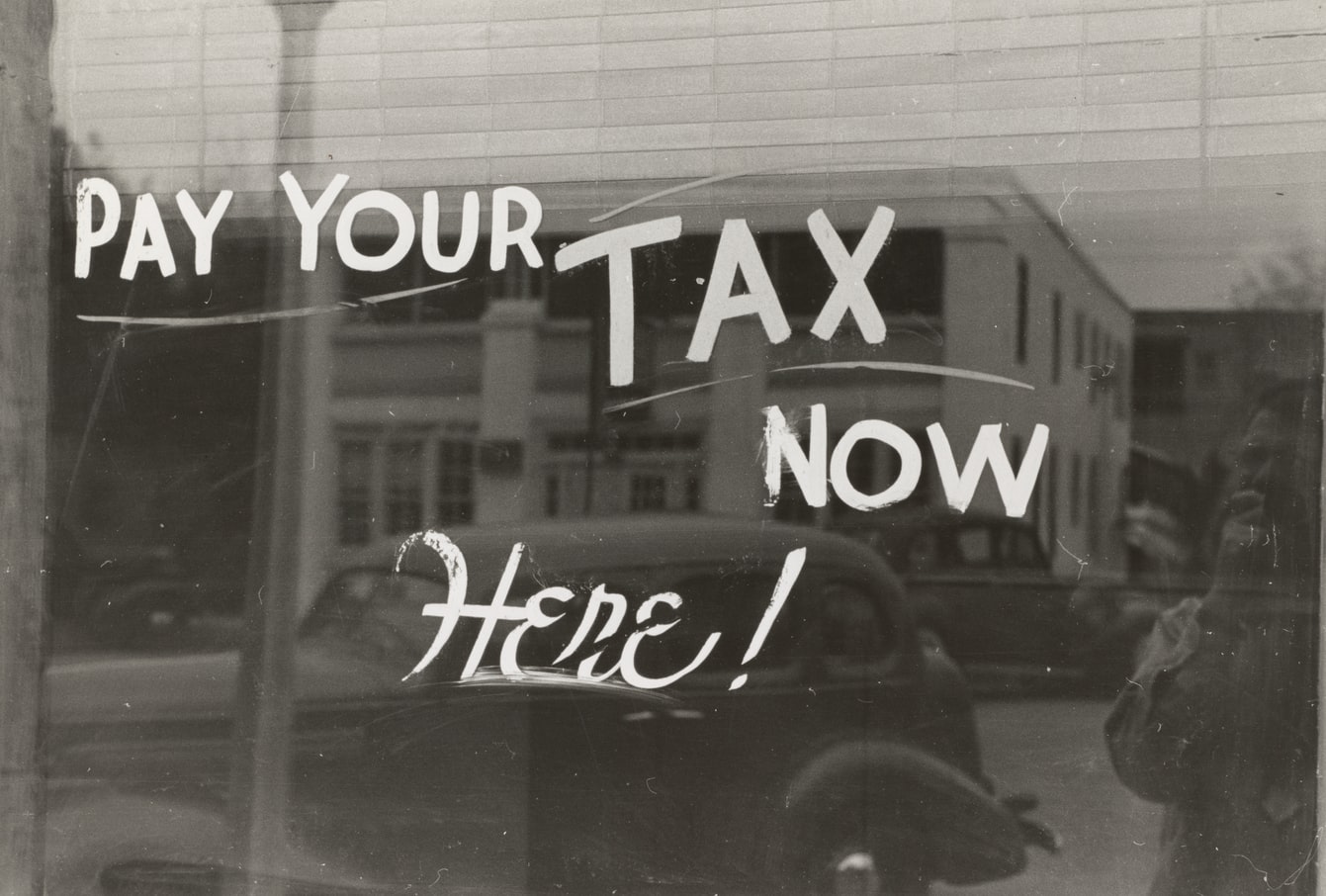

With the festive season now upon us, here's our guide to the top tax tips that will make your Christmas a tax-efficient celebration!

2 min read

2 min read

are you a brilliant payroll professional looking for that next opportunity?

By stuart ramsay on Oct 12, 2022

We are looking for a Payroll Professional, either full or part-time, who wants to take that next step

3 min read

Know your numbers before making payrises

By stuart ramsay on Aug 05, 2022

Inflation is on the up

Topics: agency growth

3 min read

Are you our next accounting superstar?

By stuart ramsay on May 30, 2022

Are you ready for your accountancy career to bloom?

Are you ready to grow and learn new things?

Are you ready to shine a light on your career?

We are looking for our next Semi Senior/ Senior Accountant, who wants to take that next step

When you join Accountancy Extra, you join a team that cares deeply about your personal growth. You’ll get help to define your personal goals and tons of support to help you achieve them

You’ll be part of a team that really cares about its client relationships. You won’t just be crunching numbers, you’ll be helping clients understand and love their finances so that they can really reap the benefits in their business

You’ll get to know your clients personally and become their trusted advisors. Our team is often invited to clients' Christmas parties, birthdays, and even the occasional wedding!

You will have the choice to work flexibly, from home, the beach, the cafe, or even the office if you’d prefer: wherever you feel most comfortable and productive to get the work done

You can start your working day early in the morning or late in the afternoon, whatever works best for you and your clients. You will be working in an environment where output is essential, not the number of hours you clock up. You will NOT be clockwatching between nine and five.

You will have a positive work-life balance. You’ll be shown how to manage your diary to avoid overwhelm. Your mental health is important to us.

You will only work with really lovely clients, wonderful people who strive to achieve their personal and business goals. We are discerning who we work with as clients; we don’t just work with anybody and everybody!

You will receive regular training, and you’ll be given time to ensure that you are up to date with the latest developments in accounting, tax & technology.

You’ll be part of an organisation that is always looking for a more efficient way of working, innovating, and challenging the way we do things. Your ideas will be valued

What you will receive working at Accountancy Extra

The salary range is between £27,000 and £32,000 per annum, based on experience

28 days holiday minimum. There’s no fighting for Christmas and New Year, as the office is closed. As we are a results-focused working environment, if you are particularly efficient then extra gifts of holiday are always given, depending on results, whether it be for that spa day or your birthday!

It’s your choice where you work - office, home, cafe, beach: whatever works for you

You’ll work in a Results-Only Work Environment. This is a different way of working that empowers our team to take control of their work and make a proactive contribution to our business and the businesses we serve. It helps all of us achieve a better balance between professional and personal achievement.

We’ll contribute to your pension scheme

We’ll support you both financially and with time for any studies you wish to undertake that’ll help grow your career

Team events. Some previous events have included the Crystal maze, BBQ’s or just a really good night out!

What do we need you to be? You will

Have at least 3 years experience in practice, be AAT qualified, ACCA part-qualified or qualified by experience

Take a balance sheet approach to preparing accounts

Be able to advise business owners in basic tax planning

Be confident looking after clients. You’ll know when to pick up the phone, offer a zoom or just say “Hi, how are you?”

Love to educate your clients on the best accounting, tax or bookkeeping practices, processes, and systems

Either love Xero or be willing to learn about Xero

3 min read

Directors - How should you pay yourselves in 2022/23?

By stuart ramsay on Apr 06, 2022

It’s the start of a new tax year and time to look at the most tax-efficient way for Directors to withdraw money from their Limited Companies.

Topics: Tax efficient salary

3 min read

Two tax increases on the horizon

By stuart ramsay on Mar 14, 2022

There are two important tax increases being introduced from April. In this blog post, we'll look at how they'll impact you and your employees.

2 min read

Can my Limited Company buy me a Bike (or E-Bike) ?

By stuart ramsay on Dec 15, 2021

Looking to reduce your carbon footprint, get fit or just avoid over-busy public transport?, then buying a bike through your Limited Company, might be the solution for you!

1 min read

Tax-free childcare for small businesses. how does it work?

By stuart ramsay on Nov 12, 2021

With more and more parents working full time, child care costs can be a serious consideration

1 min read

Mobile phones...A Tax Free benefit!

By stuart ramsay on Nov 12, 2021

As more and more people are working away from the office, providing employees with mobile phones can be a wonderful, tax-free, benefit that you can offer.

1 min read

March 2021 Budget - the headlines

By stuart ramsay on Mar 03, 2021

This lunchtime, Rishi Sunak delivered his budget for the forthcoming year. A mixed bag of news.......

2 min read

3 great reasons to set an annual budget....

By stuart ramsay on Nov 20, 2020

Yeah, we get it.....setting budgets is boring

Topics: Business Recovery business plan agency growth

1 min read

Are you the payroll expert we're looking for?

By stuart ramsay on Nov 18, 2020

We are seeking an experienced payroll administrator to join our busy payroll team on a permanent basis up to 20/25 hours per week

2 min read

extra help during covid-19 "hot off the press"

By stuart ramsay on Sep 24, 2020

Rishi Sunak has just finished his speech and announcements of the next raft of support for small businesses.

2 min read

COVID-19 small business recovery grant

By stuart ramsay on Sep 16, 2020

The Government today (15th September) launch a £20m "business recovery support grant", which is available to all small businesses

Topics: Business Recovery COVID-19

2 min read

Government summer update...incentives to get us back to work and spending

By stuart ramsay on Jul 08, 2020

This lunchtime, the Chancellor delivered his "Summer Update", announcing various initiatives to retain/ create jobs and get the economy moving again.

3 min read

How using xero can improve your cashflow

By stuart ramsay on Jul 06, 2020

Cash & cashflow have become the main focus for agencies during 2020....and rightly so!

1 min read

CBILS and R&D tax credits...be wary of this trap

By stuart ramsay on Jun 10, 2020

Lots of business owners will have been applying for CBILS or bounce back loans over the past few weeks, to access cash that will get them through the next few months.

2 min read

A big update to the corona virus job retention scheme

By stuart ramsay on May 30, 2020

The Chancellor last night announced a big update to the Corona Virus Job Retention Scheme (CVJRS).

2 min read

Bounce back Loans - Be Careful if using them to pay Directors

By stuart ramsay on May 16, 2020

Bounce back Loans (BBL's) have been a great mechanism during COVID-19 for businesses to get their hands on cash quickly and with little red tape. Their presence means that a lot of businesses will be able to trade comfortably for the next few months

1 min read

The covid-19 Top up business grant fund

By stuart ramsay on May 12, 2020

When the initial COVID -19 business rates grants were issued in March, they left many small businesses who don't pay rates with a problem. They had similar business property costs to those who qualified for small business rates relief, but couldn't claim anything to help them cover those costs

3 min read

COVID-19 Furloughing Directors.....

By stuart ramsay on Apr 07, 2020

We've been asked several questions about whether Directors can be furloughed, and, if they can, what's the procedure.

1 min read

COVID-19 library of resources

By stuart ramsay on Apr 04, 2020

We have been and will continue to be publishing various pieces of content to support you during the COVID-19 outbreak.

2 min read

COVID-19....3 tools to help you create your battle plan

By stuart ramsay on Mar 31, 2020

Topics: News

5 min read

COVD-19 Our Initial response

By stuart ramsay on Mar 26, 2020

We’d normally be focusing on tax planning & budget setting at this point in the year. The main topic for conversations with our clients though, as expected, is all around Coronavirus, and the implications it may have on their business.