This lunchtime, Rishi Sunak delivered his budget for the forthcoming year. A mixed bag of news.......

COVID Support

As previously leaked in the press last night, the furlough scheme has been extended until the end of September. Employees will continue to receive a minimum of 80% of salary. However, from July, Employers will be asked to contribute - 10% in July, rising to 20% in August & September. At this stage, we don't know what the extension means for eligibility criteria etc.

There will also be two more self employed grants available, which will now include the newer self employed who have filed a tax return for April 2020

Hiring an apprentice will now attract a payment of £3,000 (previously £1,000) as an incentive to hire

There will be a new loan scheme called "Recovery Loan Scheme". Loans will be available from £25k upwards. My guess is that this is CBILS in a new guise

Hospitality rates holiday will continue until June and then there will be a 2/3 discount for the rest of the year

The 5% VAT rate will continue until September, then there will be an interim rate of 12.5%

There will be some additional grants for Retail (£6k) and hospitality businesses (£18k)

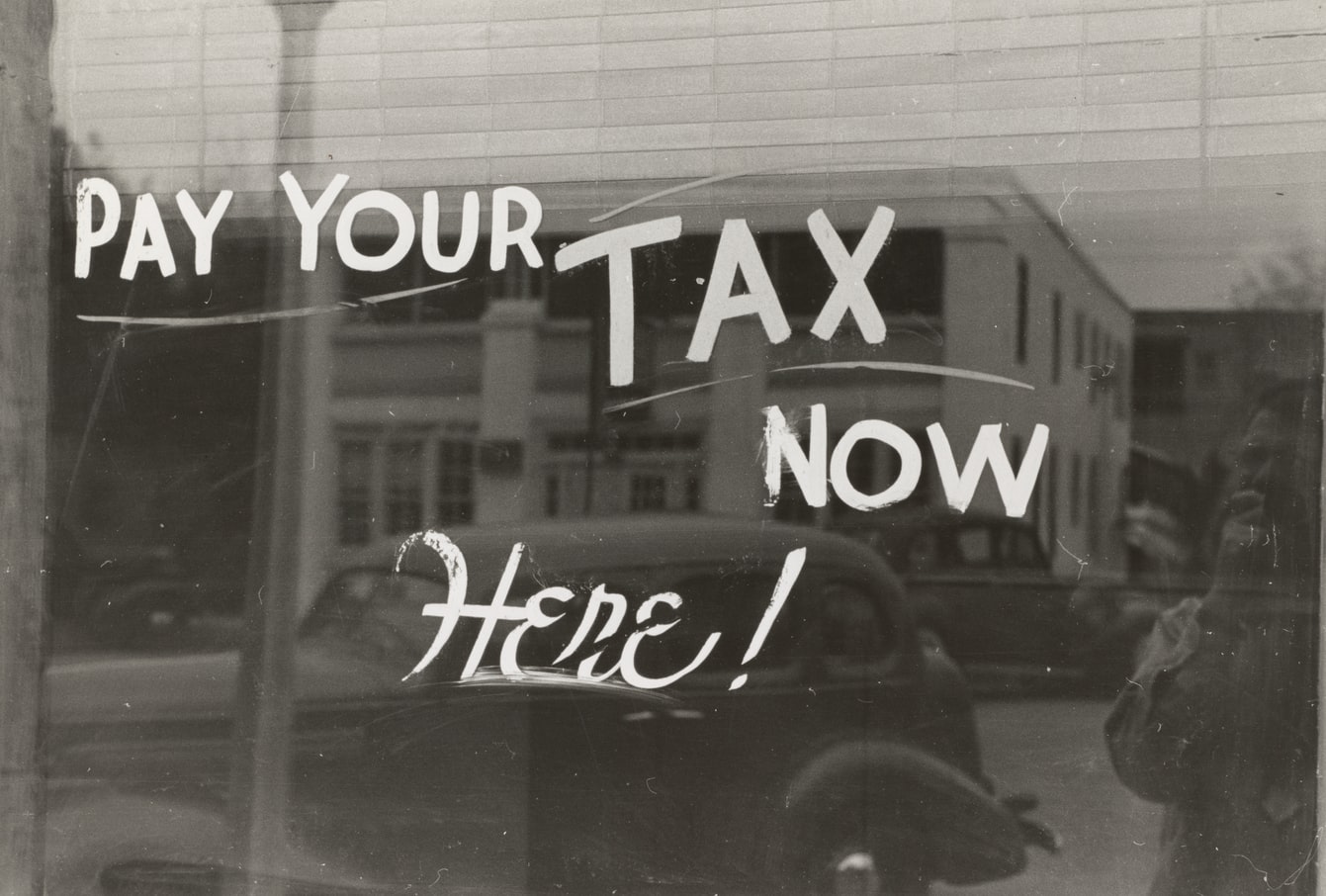

The important tax changes

With national debt at wartime levels, the Chancellor also laid out his plans from a tax perspective to start to pay back the debt

Corporation Tax

Corporation tax rates will go up from April 2023. Companies making less than £50,000 will still pay 19%. Companies making more than £250,000 will pay 25%. Those in between will pay a tapered percentage, which we think will look like this:

- Up to £50,000 = 19%

- £50,001 - £100,000 = 20%

- £100,001 - £150,000 = 21%

- £150,001 - £200,000 = 22%

- £200,001 - £250,000 = 23%

- Over £250,000 = 25%

Income Tax Rates

Income tax rates will stay as they are, but so will allowances.

Super deduction

The Chancellor made a lot noise about a new "super deduction" of 130% on capital expenditure. We aren't sure how this will work yet and if it's in addition, or instead of existing allowances