Inflation is on the up

Energy prices are on the up

The cost of living is rising

So it's not surprising that significant pay rises are at the top of both Employee and Employer agendas at the moment!

Before settling on pay rise amounts, it's important that you understand the impact on the business profitability

How will pay rises affect my profits?

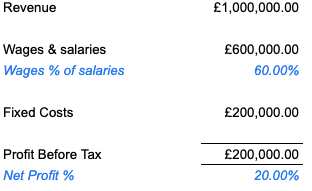

Let's think about a £1m revenue agency (I like nice round numbers!)

Like most agencies, its biggest expense is its employees. It operates at a reasonable benchmark of salaries being 60% of revenue, so, £600k

Its fixed costs are £200k

This leaves a £200k profit (20% of revenue)

The Profit & Loss account would look like this

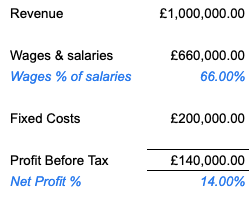

At the rate inflation is going, you may be considering a pay rise of, say, 10%. If everything else stays the same, the P&L will now look like this

As you can see, there's a 6%/ £60k reduction in net profit from giving out a 10% pay rise. No surprises there!

At this level, the agency still remains profitable, albeit less so than before

But what if my salaries are higher than 60% of revenue?

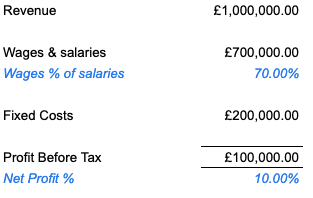

Let's consider another £1m revenue agency, but this time its salary bill is 70% of revenue. The P&L would look like this

The first observation is that, even in its base position, it's only making a 10% profit

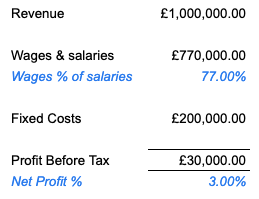

Now, if we give everyone a 10% payrise, the numbers look like this

Ouch! The agency is now only just breaking even! The smallest of client losses or reduced revenue will make it loss-making. At this level, cash will be tighter than it ever has been before. The owners may not be able to take their full drawings and, before long, will have to take radical measures to keep afloat

What can we do to prevent this?

I think decent pay rises are inevitable in 2022 if we want to keep hold of our talent. Employees know that if we don't pay them well, someone else will.

So, what can we do to mitigate the rises?

First of all, it's essential to review your pricing. In scenario 1, an increase of 6% would get the agency back to where the was before, in scenario 2, it'd need to be 7%. Is it time to bite the bullet and review the rate cards? I know a lot of agencies who have done this for 3 years or more, due to the impact of COVID/ Brexit, etc.

Secondly, take a close look at where you are "leaking" profit in the business. Are:

- Are all clients profitable, or are profitable ones subsidising loss-making ones?

- Are all projects hitting the profit targets you've set for them?

- Are clients sneaking in "freebies" and the team is too nice to say no?

- Are you suffering from scope creep in retainer clients?

Thirdly, take a look at where you can cut back on fixed costs. this is often the most tempting thing to tackle and is generally first on everyone's list. However, its benefits are limited (in our example, we'd have to carve £70k out of a total spend of £200k). Having said all that, I'm always an advocate of cost reviews in areas such as IT subscriptions (have we got 15 Google licenses when we've got 10 employees?)

Final thoughts

Knowing your numbers and the impact changes will have is vital BEFORE you go ahead and implement any pay rises. Model them through and understand the impacts

We work on Forecasting with a number of clients and they all have access to their own model where they can run through "what if?" type scenarios. We often find this useful, not just when faced with challenges such as this, but when we are assessing the impact of hiring, or taking on a new client